What are large cap funds?

In India, companies listed on the stock exchanges between 1 – 100th in terms of full market capitalization are called Large Cap companies (Large Cap stocks).Large cap funds are equity mutual fund schemes which have to invest at least 80% of their assets in large cap stocks.

Characteristics of large cap stocks

-

- Large cap companiesare typically large in size in terms of sales. Generally, they are amongst the biggest companies in India andare household names.

-

- Large cap companies have proven history and stable business models. The average age of companies which form part of the Sensex (30 largest companies by market capitalization) ranged between 48 to 56 years over the last 20 years i.e. on average most of these companies have been in existence for nearly 50 years (source: Value Research).

-

- Normally Large cap companies are leaders in their respective industry / sectors in terms of market share. As such these companies are usually better positioned to survive economic downturns.

-

- The core sectors of the Indian economy like coal, oil and gas, petroleum products, steel, cement, power etc. are dominated by large cap companies. Many of these sectors are highly capital intensive and significant barriers to entry. As such, large cap companies dominating these sectors enjoy the advantage of deep competitive moats.

-

- Large caps usually have large percentage of institutional (FIIs and DIIs) ownership compared to midcaps and small caps. Large caps are well researched and provide better visibility of earnings compared to midcaps and small caps.

-

- Generally, large caps have large percentage of institutional ownership, they are traded in large volumes in the stock market and are highly liquid. Midcaps and small caps, on the other hand, typically have large percentage of promoter ownership. Since midcaps and small caps have smaller percentage of free-floating shares, they trade on thinner volumes compared to large caps and are hence, relatively less liquid compared to large caps.

- Large caps have relatively lesser risk in downturns (owing to their market share leadership) and provide more earnings visibility compared to midcaps and small caps, they usually may command higher valuations compared to midcaps and small caps.

Large cap versus mid / small cap funds

-

- As per SEBI’s mandate, large cap funds must invest at least 80% of their assets in large cap stocks. Midcap and small cap funds must invest at least 65% of their assets in midcap (101st to 250th stocks by market capitalization) and small cap (251st and smaller stocks by market capitalization) stocks respectively.

-

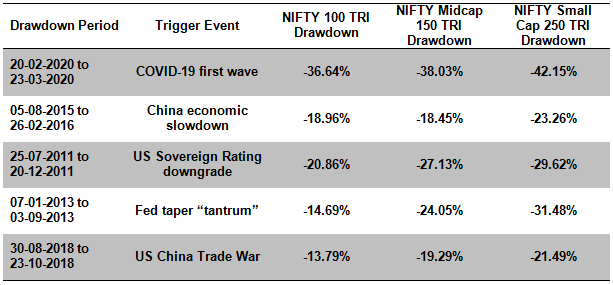

- Large cap funds are less volatile than midcap and small cap funds. Historically large cap stocks have seen lesser drawdowns (correction from market tops) in bear or highly volatile markets. The table below shows the 5 biggest drawdowns in the market over the last 10 years. You can see that large caps (represented by Nifty 100 TRI) had smaller drawdowns compared to midcaps (represented by Nifty Midcap 150 TRI) and small caps (represented by Nifty Small Cap 250 TRI).

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.06.2011 to 29.10.2021. Disclaimer: Past Performance may not be sustained in the future

- Large cap funds are less volatile than midcap and small cap funds. Historically large cap stocks have seen lesser drawdowns (correction from market tops) in bear or highly volatile markets. The table below shows the 5 biggest drawdowns in the market over the last 10 years. You can see that large caps (represented by Nifty 100 TRI) had smaller drawdowns compared to midcaps (represented by Nifty Midcap 150 TRI) and small caps (represented by Nifty Small Cap 250 TRI).

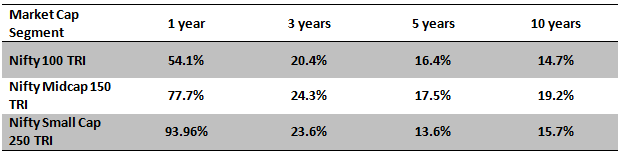

- Midcap and small cap funds have the potential of outperforming large cap funds in different performance periods. Also, since midcap and small cap funds invest in a bigger universe of stocks which are not as well researched as large caps, potential of alpha creation is higher. However, large cap funds provide greater stability to your investment portfolio.

Source: National Stock Exchange, Advisorkhoj Research. Returns for periods exceeding 1 year are in CAGR. Period: 01.11.2011 to 29.10.2021. Disclaimer: Past Performance may not be sustained in the future

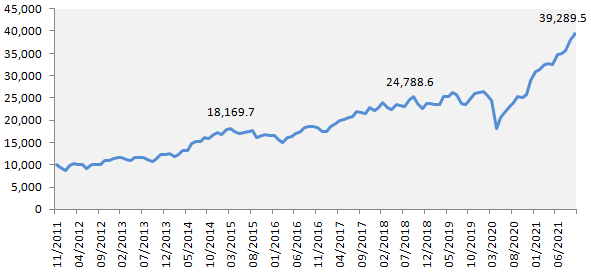

Wealth creation by large caps

The chart below shows the growth of Rs 10,000 investment in Nifty 100 TRI (index assumed for large cap stocks) over the last 10 years (ending 29th October 2021). You can see that the investment would have multiplied nearly 4 times (to Rs 39,289) in the last 10 years at a CAGR of 14.7%.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.11.2011 to 29.10.2021. Disclaimer: Past Performance may not be sustained in the future

Suggested reading: Understanding different kind of mutual fund returns

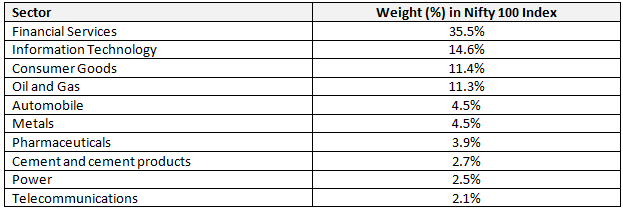

What kind of companies are large cap?

The table below shows the top 10 industry sectors in the Nifty 100 index (index of all large cap stocks).

Source: National Stock Exchange, Nifty 100 Factsheet, as on 29th October 2021.

Who should invest in large cap funds?

-

- Investors who are looking for capital appreciation over long investment tenures

-

- Investors who prefer relatively less volatility in their portfolio

-

- Large cap funds can be good investment options for new inexperienced investors who want exposure to equity. You may like to read how to build a resilient portfolio

-

- Investors with moderately high to high risk appetites

- Investors with at least 5 years investment tenure

Why invest in large cap funds?

-

- Exposure to the largest companies and well known brands

-

- Wealth creation in the long term with potential lesser downside risks

-

- Generally provides High liquidity in volatile market conditions. Did you know what is volatility and how to deal with it

-

- Ability to recover faster from deep corrections

- Relatively stable investment experience

Investors should consult with their financial advisors if large cap funds are suitable for their investment needs.

[“source=advisorkhoj”]